Technical Analysis Explained PDF is a book that serves as a comprehensive guide for traders, whether novice or experienced, seeking to delve into the intricacies of technical analysis. Authored by Martin J. Pring, a renowned technical analyst, the book has gained widespread recognition for its clarity, depth, and practical insights into the realm of trading strategies.

| Name of PDF | Technical Analysis Explained |

|---|---|

| No Pages | 814 |

| Author | Martin J. Pring |

| Published | 1985 |

| Language | English |

| Genres | Business & Career |

| Size | 8.06 MB |

| Chek, latest edition |

Table of Contents

Introduction to Technical Analysis Explained book

Technical Analysis Explained introduces readers to the fundamental principles and methodologies of technical analysis, an essential tool in the arsenal of any successful trader. Through the analysis of historical price data and volume, technical analysis aims to forecast future price movements, thereby aiding traders in making informed decisions.

What is Technical Analysis?

At its core, technical analysis involves the study of past market data, primarily price and volume, to forecast future price movements. It operates under the premise that historical price trends tend to repeat themselves, enabling traders to identify potential opportunities and risks in the market.

Overview of the Technical Analysis Explained book

Martin J. Pring, the author of Technical Analysis Explained, is a leading figure in the field of technical analysis, with decades of experience in market analysis and forecasting. In his book, Pring provides readers with a comprehensive overview of technical analysis, covering topics ranging from basic principles to advanced trading strategies.

Key Concepts Covered

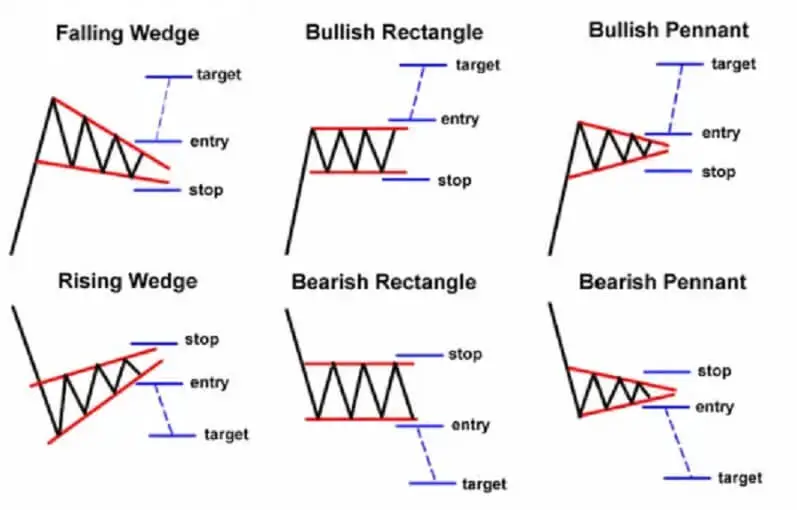

The book delves into various key concepts of technical analysis, including candlestick patterns, support and resistance levels, and moving averages. These concepts serve as the building blocks for understanding market dynamics and formulating effective trading strategies.

How to Use Technical Analysis for Trading

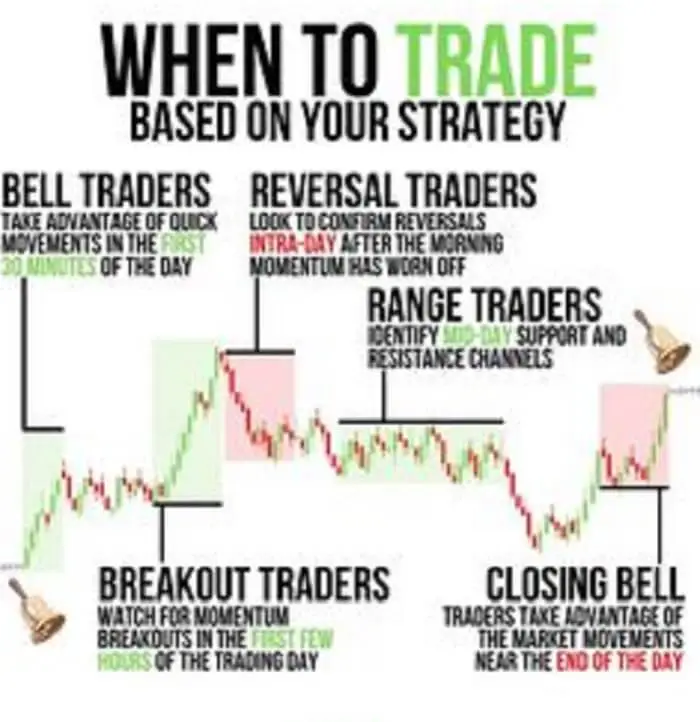

Technical Analysis Explained offers practical guidance on how to apply technical analysis techniques in real-world trading scenarios. By identifying trends, interpreting chart patterns, and utilizing technical indicators, traders can gain valuable insights into market behavior and make well-informed trading decisions.

Advantages of Technical Analysis Explained book

One of the notable advantages of Technical Analysis Explained is its accessibility. Unlike many technical analysis books that are laden with complex jargon and equations, Pring’s book presents concepts in a clear and concise manner, making it suitable for traders of all skill levels.

Criticisms and Limitations

Despite its merits, Technical Analysis Explained is not without its criticisms. Some argue that technical analysis is inherently subjective, relying heavily on interpretation and intuition rather than objective data. Additionally, critics point out that technical analysis may be ineffective in predicting major market crashes or sudden shifts in market sentiment.

Real-life Applications

The book provides numerous real-life examples and case studies to illustrate the practical application of technical analysis techniques. By analyzing historical price charts and market trends, readers can gain valuable insights into the dynamics of various financial markets and learn how to apply technical analysis principles in their own trading strategies.

Conclusion

In conclusion, Technical Analysis Explained serves as an invaluable resource for traders seeking to enhance their understanding of technical analysis and improve their trading skills. With its comprehensive coverage of key concepts, practical insights, and real-life examples, the book equips traders with the knowledge and tools necessary to navigate the complexities of financial markets with confidence.

FAQs about Technical Analysis Explained PDF

What makes Technical Analysis Explained different from other books?

Technical Analysis Explained stands out for its clarity, accessibility, and practicality. Unlike many technical analysis books, it presents concepts in a straightforward manner, making it suitable for traders of all levels.

Can beginners understand the concepts?

Yes, Technical Analysis Explained caters to traders of all levels, including beginners. The book starts with the basics and gradually builds upon them, making it accessible to newcomers to the world of technical analysis.

Is technical analysis suitable for all types of markets?

While technical analysis can be applied to various financial markets, its effectiveness may vary depending on market conditions and factors such as liquidity and volatility.

How can one apply the book’s teachings in real-life trading scenarios?

Readers can apply the concepts and strategies outlined in Technical Analysis Explained by practicing technical analysis techniques on historical price data and incorporating them into their trading plans.

Are there any online resources to supplement the book’s teachings?

Yes, there are numerous online resources, including forums, blogs, and educational websites, that provide additional insights and support for traders looking to deepen their understanding of technical analysis.

What are the methods of technical analysis?

Chart patterns and technical (statistical) indicators

What are the four basic principles of technical analysis?

Trends, Patterns, Indicators, and Entry Signals